Sarine Technologies Ltd reported its financial results for the first half of 2024, achieving a net profit of $1.02 million – a 7% year-on-year increase, despite a 7.8% decline in total revenues to $21.9 million.

Sarine’s profitability benefited from cost reduction strategies and growth in recurring revenue streams, which helped offset the decline in equipment sales tied to the natural diamond market.

Market Context: Natural Diamonds and Lab-Grown Diamonds

The broader diamond market experienced considerable challenges in H1 2024, with demand for natural diamonds weakening, especially in China.

In the U.S., the growing popularity of lab-grown diamonds (LGD) has disrupted the market, though this segment is also facing hurdles, including surging production and rapidly falling prices. Wholesale prices for LGD fell between 20% and 50%, depending on size and quality, forcing U.S. retailers to reassess their LGD offerings due to diminishing profit margins.

Recurring Revenue Growth Offsets Equipment Sales Decline

Sarine’s revenue decline in H1 2024 was attributed primarily to a 37% drop in sales of traditional capital equipment. However, recurring revenues rose by 11% and now account for more than 70% of total revenues. This growth in recurring revenues was supported by several new strategic initiatives. Trade-related recurring revenues, in particular, saw significant growth, increasing 44% and now making up 26% of total revenues, compared to 17% in H1 2023.

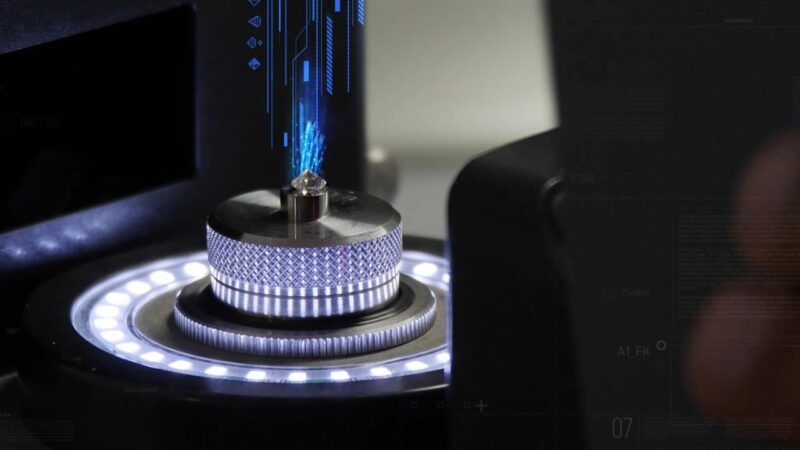

Sarine’s new recurring revenue initiatives include the launch of its Most Valuable Plan™ (MVP) for the planning of smaller rough natural diamonds and adaptations of its rough planning technologies to serve the growing LGD market. The company opened a grading lab in India to support the Indian LGD industry and introduced services such as AutoScan™ Plus and the Sarine Diamond Journey™, which assist with regulatory compliance and address market demands.

Profitability Supported by Cost-Cutting Measures

Sarine’s return to profitability can be attributed to focused cost management. Net profit for H1 2024 increased to $1.02 million from the same period in 2023. The company has also declared an interim dividend of 0.75 U.S. cents per share, a significant increase from last year’s 0.25 cents per share. This dividend will be payable on 12 September 2024.

Outlook for the Remainder of 2024

Looking ahead, Sarine remains cautious about the near-term outlook for the natural diamond market. Continued weak demand from China and ongoing disruptions from the LGD market are expected to maintain pressure on rough diamond manufacturing. However, the company is optimistic about its strategic initiatives, which are expected to generate significant long-term growth, particularly in recurring revenue streams. The company projects that LGD-related services could make up 15-20% of its total revenue by the end of the year.

Sarine is also preparing for further expansion of its grading services, particularly in the LGD sector, as the newly launched GCAL by Sarine lab in Surat, India, gains traction. The company expects demand for rough natural diamonds to recover as market dynamics shift and new marketing campaigns for natural diamonds are launched.